Dividend for preferred shares formula. What is a dividend per share?

Increasing inflation, which the Central Bank cannot yet control, low licenses for commercial banks, and instability in the quotation of expensive metals are making Russians look for alternative investment methods. People who have a reasonable level of financial literacy and knowledge of basic financial tools are increasingly choosing to invest in dividend-paying stocks. We will briefly inform you about the dividends and how dividends are paid on shares in Russian companies.

What are dividends on shares?

The meaning of the concept of “dividends” is given in Art. 43 of the Tax Code of the Russian Federation. Dividends are subject to consideration of any income that is withdrawn by the shareholder (investor) from the company during the distribution of profits, which is lost after distribution (including dividends for preferred shares), per share The shares that belong to the shareholder are in proportion to the shares of the shareholders in the statutory capital of the company.

Preferred shares are due to the fact that they pay a fixed dividend, as required by the statute of the enterprise (for example, maybe 10% of the profit or 5% of the nominal profit and shares). Preferred shares do not carry voting rights during the election of directors or directors. The law states that dividends on preferred shares cannot be less than dividends on primary shares. The amount of income that supports payments for preferred shares is included in the total amount of dividends. To find out how much the investor withdraws from one primary share, it is necessary to divide the difference that comes out into the number of primary shares.

How dividends are paid in Russian companies

To withdraw dividends from the shares of Russian companies, you need to be aware of the upcoming dates:

- Ex-dividend date is the date on which the company's shares must be transferred in order to cancel dividends. As of 2014, this “death date” cannot be set before the decision on the payment of dividends has been approved, and before the secret tax collection of shareholders is carried out. Remember that since the spring of 2013, the “T+2” trading mode in Russia has set a cut-off date before you need to buy shares in order to register before dividends - no later than 2 days and before the registry closing date.

- The date of the decision to pay dividends is confirmed by illegal river collections of shareholders on the basis of proposals for directors.

- The date of holding the shareholder dues is after the closing date of the register for participation in the dues (set by a number of directors), and before the closing of the register for dividends.

- The closing date of the register for dividends is the remaining date of the register of persons who have the right to withdraw dividends. Since 2014, it will be confirmed by the collection of shareholders on the basis of recommendations for directors and may occur no later than 20 days and no earlier than 10 days after the collection of shareholders . Important: dividends will only be paid to those people who were entered before the register 2 days before the closing date. In this case, it is not obligatory to hold shares for a whole life: you can buy valuable shares of the company a month before the closing date of the register and still deduct dividends.

- Dividend payment date - the date when the shareholder withdraws due dividends (if dividends are paid once per year). On 01/01/2014, the term for payment of dividends was established - 25 days from the date of the ex-dividend date.

It is significant that in 2013 the process of assigning certain dates has significantly changed from what is going on at the same time. Illya Balakirev, an analyst at UFS IC, says that now at the time of the “selection” for dividends, the investor knows exactly when the amount of dividends will be confirmed. Therefore, the risks of dividend strategies will be significantly reduced. Also having a positive impact on the market is the shortening of dividend payment terms (previously it was 60 days).

Also, the changes that have arisen since 2014 will apply to the primary structure of wealthy companies. Since previously almost all stockholder fees were held in the stock market, and the registers were closed in the stock market, then, when the stock market became active, the situation will soon change. Now the interest of investors in securities papers increases in the future and declines after the date of dividend payments. For example, in the calendar for Gazprom, the secret gathering of shareholders is scheduled for 27 cherubs, therefore, in order to collect dividends from the company's operating accounts for the past period, shares can be added to the company.

To understand how to choose a company in which you will become an investor, and what income you can invest, it is important to understand the mechanism for determining the amount of dividends. More details about this.

How is the amount of dividends calculated?

Apparently smartly, the company divides the entire net profit withdrawn from the market into 2 parts: one goes directly to business development, and the other is distributed among the shareholders in proportion to their parts. Decisions about how much will be invested in the business, and how much will be seen by shareholders, are taken at the current shareholder meetings.

If the company is operating in the red, then shareholders may praise the company's decision to pay dividends. However, if the profits are withdrawn, shareholders may lose without payments: it is necessary to straighten all the money for further development of the business, which will be a priority.

Shares of a skin company are assessed by their dividend yield, which is determined as the hundredth of the dividend on the share before the market price of the stock. In Russia, a good level of dividend yield is considered to be 5-10%.

Thus, it is difficult to earn money, but in order to get the maximum income for the minimum expenses, it is important to choose the right company in which you will become a shareholder, and immediately add shares. About how to earn money - we know from the statistics -

The shareholder - the holder of the preferred share as the owner - can withdraw part of the profits of the joint-stock partnership in the form of dividends (Clause 1, Article 67 of the Central Committee of Ukraine; Articles 32, 42 of the Federal Law dated 26 April 1995 N 208-FZ "On joint stock partnerships") . Sometimes, the practical implementation of this feasibility often presents difficulties.

In the scientific civil law, dividends mean a part of the net profit of a joint-stock partnership, collected from the accounts of its activities for the previous period, which is charged for shares in their category. ta type.

Subject to paragraph 2 of Art. 32 of the Law on Joint Stock Partnerships, the skin type may be indicated in the statute of a joint stock partnership in a hard penny amount or in hundreds of up to the nominal value of the preferred shares. The amount of dividends on preferred shares is also taken into account, since the statute of the partnership establishes the procedure for its allocation.

The size of the dividend under the partnership statute is one of the advantages that shareholders are entitled to - the holders of the preferred shares, since their participation in the company's profits is equal to the holders of the preferred shares.

In economic literature, the phenomenon of preferred shares is explained by the fact that instead of participating in the managed partnership, such shareholders acquire a guaranteed right to withdraw income from activities partnership and the partnership guarantees the income between the shareholders by taking back the assigned (fixed) dividend.

The Code of Corporate Conduct also recommends that the mechanism for determining the size of dividends and their payment be wise and reasonable for the shareholders of the partnership (clause 1.1 of Chapter 9 of the Code of Corporate Conduct for the 5th quarter June 2002 (addition to the regulation of the Federal Commission for the Promotion of the Russian Federation in the 4th quarter of 2002 N 421/R); clause 2.10 § 2 Concepts for the development of legislation on legal issues (draft recommendations for the Codification and Improvement of Civil Legislation under the President of the Russian Federation, Protocol No. 68 dated 16 February 2009)).

Subject to the law, the amount of the dividend on preferred shares may be determined by the statute of a joint stock partnership in three ways.

First of all, the size of dividends can be calculated in hard penny sums, expressed in Russian rubles.

The ruble is a legal means of payment, subject to acceptance at nominal value throughout the entire territory of the Russian Federation. All financial obligations are expressed in rubles. The use of foreign currency on the territory of Russia is allowed in cases and in accordance with the law or in the order established by it (Articles 140, 317 of the House of Culture of the Russian Federation; Federal Law dated 10 April 2003 N 173-FZ "On currency regulation and foreign exchange control" ").

Alternatively, the amount of dividends can be set in hundreds up to the nominal value of the preferred shares.

Each share has a nominal value as reflected in the statute of a joint stock partnership. Preferred shares of one type are subject to the same nominal value (Articles 11, 32 of the Law on Joint Stock Partnerships). The nominal value of the share as a stock of the statutory capital of the joint stock partnership is also expressed in Russian rubles.

Thirdly, the amount of dividends on preferred shares can be calculated according to the order established by the statute of the partnership.

Legislation does not take revenge on special forces in such a manner. Therefore, it is entirely acceptable to establish a rule in which the size of the dividend will be related to the amount of the net profit of the joint stock company.

For example, the statute of a partnership may stipulate that dividends are collected on one preferred share in the form of a small portion of the net profit of the partnership.

Establishing the size of the dividend for preferred shares both for a hard penny amount and for hundreds of shares based on the nominal value of the share makes it possible to determine the exact value.

Another way may also allow dividends to be released. In addition, it is possible to set the amount of the dividend on the preferred shares to the amount of the dividend on the main shares of the partnership.

The size of the dividend cannot be determined by the will of the matrimonial bodies. for the sake of directors and secret gatherings of shareholders.

Therefore, the assigned competence of the management body of the joint stock company, which has the right to make decisions on the size of the dividend, cannot be respected by the established procedure for determining the size of the dividend.

As stated in the literature, such a provision of the statute refers only to the authority that determines the amount of dividends, but does not establish the authority’s procedure for determining its amount.

A similar legal position is supported by court and arbitration practice.

The provisions of the statute stipulate that decisions on the size and payment of dividends are taken by secret collections of shareholders for the recommendations of the directors of the partnership, and the amount of dividends cannot be greater for the recommendations of a number of directors, the court ruled without recognizing the rule that establishes the procedure for determining the size of dividends for preferred shares ( Resolution of the Federal Arbitration Court of the Pivnichno-Caucasian District dated February 13, 2008 (N F08-243/08 at reference N A32-12734/2007-62/298).

As a procedure for determining the size of the dividend on preferred shares, it is not possible to qualify the provisions of the statutes of joint stock companies that establish either a minimum or maximum between the size of the dividend. In certain cases, the amount of dividends is subject to the will of the management bodies of the partnership, so that the owners of the preferred shares are not included (Clause 1, Article 32 of the Law on Shareholders of the Partnership).

Therefore, the provisions of the statutes about the amount of dividends for preferred shares on the capital “up to X hundred hundred income of the partnership” the court is ordered not to properly determine the amount of dividends (Resolution of the Seventeenth Arbitration No. 17AP07-168 to the Court of Appeal dated 29 February 2007).

Subject to paragraph 2 of Art. 32 of the Law on Joint Stock Partnerships, owners of preferred shares, under which the partnership statute does not specify the amount of dividend, have the right to withdraw dividends on a par with owners of preferred shares.

This means that shareholders - owners of preferred shares have the right to withhold dividends in the same amount as owners of preferred shares.

The law relates to the payment of dividends on the principal shares of the estate. Just as shareholders - holders of preferred shares withdraw dividends in the amount per share, then shareholders - holders of preferred shares are responsible for withdrawing such dividends themselves.

It is true that the right to share in the distribution of profits withdrawn from the partnership’s activities during the current period is subject to the basic rights of a participant in the sovereign partnership (Clause 1, Article 67 of the Central Committee of Ukraine).

At the same time, today from this station. 42 of the Law on Joint Stock Partnerships, payment of dividends is a right, not a legal obligation of the partnership.

If such a decision is not made, then the shareholders - owners of the preferred shares, the amount of the dividend as specified in the statute of the partnership, will deny the ability to take part in secret elections from the right to vote from all sources of their competence. ї (Article 32 of the Law on Joint Stock Partnerships).

It is clear that the voting rights of owners of preferred shares, the amount of dividends specified in the partnership statute, may be signs of additional rights, which belong to the creditor of the optional bond.

In the event of a decision regarding the announcement of dividends, the partnership has no right to pay, and the shareholders have no right to extract their payment.

The fairness of this award is confirmed by the current legal position established by the arbitration courts (clause 15 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated November 18, 2003, No. 19 “About the acts of nutrition under the Federal Law” About shareholder partnerships").

If the management decides to pay dividends, then the shareholders have a subjective right to collect their payments.

A joint stock company is required to pay dividends on shares of each category (type), according to the lines and order specified in the statute of the partnership or decided on illegal duties of shareholders regarding the payment of dividends (Article 42 of the Law on Joint Stock Partnerships).

The remaining dividends are paid a pittance, and a penniless liability arises between the joint stock company and the shareholder.

Thus, when secret meetings of shareholders make a decision on the payment (vote) of dividends for special shares in the designated size, in the order of the line, for shareholders - holders of preferred shares, for which one hundred here the partnership does not specify the size of the dividend, which is due to the right of recourse to the partnership about the payment of a dividend in the same amount as the dividend on primary shares.

It is worth mentioning that this right rests with the shareholders - owners of the preferred shares on the basis of clause 2 of Art. 32 of the Law on Joint Stock Partnerships, moreover, whenever, regardless of the reasons, the partnership has decided to pay dividends only on primary shares.

The reason for the size of the penny tax for the payment of dividends to shareholders - owners of preferred shares - is directly transferred to clause 2 of Art. 32 The Law on Joint Stock Partnerships cannot be affected or amended by the decisions of the management bodies of the joint stock partnership.

Failure to pay the announced dividends by the partnership at full scale in the establishment of terms after the decision to pay and in accordance with the established procedure is an illegal obligation of the partnership and violation of the rights of the shareholder.

When paying dividends in a smaller amount, paragraph 2 of Art. 32 of the Law on Joint Stock Partnerships violates the right of shareholders - holders of preferred shares to withdraw dividends on an equal basis with holders of preferred shares.

If a joint stock company that has voted to pay dividends does not actually pay them, then the entities included in the list of individuals who have the right to withdraw dividends may go to arbitration court to protect their damages They have no rights in the lines, provisions of paragraph 5 of Art. . 42 of the Law on Joint Stock Partnerships.

Zokrema, the shareholder-owner of the preferred shares can go to the arbitration court with a call to the joint stock partnership for the reduction of unpaid sums.

In addition, the shareholder can extract from the partnership payment of hundreds of thousands for the completion of the penny crop duty (Article 395 of the Central Committee of Ukraine; paragraph 16 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated November 18, 2003, No. 19 " About the actions of nutrition according to the Federal Law "On shareholders' partnership ").

At times, if the statute of the partnership does not specify the amount of dividends for the preferred shares, then secret meetings of shareholders make decisions on the payment of dividends, depending on the amount of the dividend per one primary share. It exceeds the size of the dividend per one preferred share, shareholders - holders of preferred shares have the right to receive additional payments from the partnership There appears to be a difference between the stated size of the dividend on preferred shares and the size of the dividend on preferred shares, as well as payment of hundreds (Article 15, 395 of the Civil Code of the Russian Federation; Article 32 of the Law on Shareholders partnership).

Primus's collection from the partnership of the due shareholder of the underpaid amount of dividends is a major fallout of the award to the exaction of liability in kind (paragraph 8 of Article 12 of the Central Committee of Ukraine).

This method of protecting civil rights, transferred by law and expansions in judicial and arbitration practice, demonstrates the essential nature of the transactions between the joint stock partnership and the shareholder with the drive to pay the dividend.

The obligation to pay dividends is an element of the increased liability specified in clause 2 of Art. 32 of the Law on Joint Stock Partnerships, unless it was a joint stock partnership of the proper rank (at all sizes).

Unless otherwise provided by law or treaty, the Primus Vikonanny bond in nature is stagnated in the event of an illegal law enforcement duty (Clause 1, Article 396 of the Central Committee of Ukraine).

Judgment prior to the proper prosecution of civil rights law confirms the principle of real prosecution of civil legal claims.

It should be noted that in the analysis of the situation there is no need to discredit the decisions of directors regarding recommendations for the amount of dividends on preferred shares and (or) illegal meetings of shareholders regarding the payment of dividends for preferred shares of a smaller size, as established below, in accordance with clause 2 of Art. 32 of the Law on Joint Stock Partnerships.

On the right is that, due to its legal nature, the right to challenge the decisions of the matrimonial bodies is protective and is seen as a renewal of the status that existed before the violation of the right (paragraph 3 of Article 12 of the Central Committee of Ukraine).

Therefore, it is a legal consequence that the court declared invalid the decision of illegal collections of shareholders regarding the payment of dividends, which will provide a legal framework for their removal.

Dividends paid as a result of the non-functional resolution of illegal fees of shareholders, and to unpaid shareholders and to the related joint stock partnership (Article 1102 of the RF DC) (Resolution of the Federal Arbitration Code) Court of Justice of the Ural District dated 15 June 2009 N F09-1011/ N A50-4153/ 2008-Y21).

Whose court does not have the right to demand a spouse to accept any other (legal) decision from that person and establish a decision in the court act.

The most popular food has divided the income and the surplus into the guilty competence of the estate itself, based on the indicators of its financial and state activity.

Judicial control will ensure the protection of the rights and freedom of shareholders, but does not prevent the verification of the economic efficiency of decisions that are taken by a number of directors and (or) secret gatherings of shareholders (Disposition of the Constitutional Court Russian Federation dated 10/16/2007 N 677-О-О).

Also, by making the decision invalid, it is impossible for the body of the joint-stock partnership to steal (renew) the right of the creditor shareholder to withdraw the dividends from the partnership.

In this manner, in a proper way, the protection of the violated rights of shareholders - the owners of the preferred shares - is presented before the partnership to the winner (calls) for the award before the proper conclusion of the marriage obligation for the payment of dividends and reduction in Hundreds of dollars for stealing other people's money (paragraph 8, article 12, Art. 15), Art. 395 of the Central Committee of the Russian Federation; Art. 32 of the Law on Joint Stock Partnerships).

MANAGEMENT OF SHARES

Zavdannya 1

Methodical insertions

Dividend -

Nominal value of the share Rn

N Npr, Other conditions - Nob

Balance sheet value of the share RB

Rink's share of shares RR

Dividend rate on shares – i

Dividend amount I

Decision

The profits that are lost are distributed among the authorities of the primary shares

Iob = 950,000 rubles / 400,000 pcs = 2.375 rubles per share

Significant profitability:

For preferred shares, the won is set at a dividend rate of 5%

For initial stock: i pro = Iob / Rn = 2.375 rub / 10 rub = 0.2375 or 23.75%

Subject:

| -?- |

Zavdannya 2

The investor added 400,000 rubles. package of shares (100,000 pieces) AT with a nominal value of RUB 300,000. (3 kr. per piece) For each share of the package, dividends were paid to the first company in the size of 5% of the river, in the other company of the size of 6% of the river. After 2 years, the package was sold for 450,000 rubles.

This means the nominal and market flow and terminal yield of one share.

Methodical insertions

The profitability of a share is the correlation of income that a share brings to the owner with the share price. Income from shares is divided into: more precisely(dividends, which are calculated sharply) and kintsevi(related to the change in the market price of the share, it is determined at the time of sale of the share by the owner as the difference between the purchase price and the sale price plus all dividends are deducted).

Pributkovyst nominal Rн - the share of income that the shareholder is given to bring to the owner nominal Based on the price of the share, you can evaluate the current Rn/t for the current income and the final Rn/k for the terminal income.

Pributkovyst Rinkova R - the ratio of income that the share is given to the owner market The value of the share price can be assessed by the current Rt for the current income and the terminal Rk for the terminal income.

Decision

We cover the current income (dividends)

For the first person: I1 = i1 * Рн = 5% * 300,000 = 0.05 * 300,000 = 15,000 rubles

For another person: I2 = i2 * Рн = 6% * 300,000 = 0.06 * 300,000 = 18,000 rubles

In-line nominal yield traditional dividend rate,

Likely 5% in the first generation and 6% in the other generation.

Current market return:

RT 1 = 15,000 rubles / 400,000 rubles = 0.0375 3.75%

RT 2 = 18,000 rubles / 400,000 rubles = 0.045 4.5%

We will cover the end profits

15,000 rub. + 18,000 rub. + (450,000 rubles - 400,000 rubles) = 82,000 rubles

Kintseva nominal yield

Rk/n = 82,000 rubles / (300,000 rubles * 2 rocks) = 0.137 or 13.67%

Kintseva market return:

Rk/n = 82,000 rubles / (400,000 rubles * 2 rocks) = 0.1025 or 10.25%

Vіdpovid

DEPRECIATION REQUIREMENT

Zavdannya

You will see the amount of depreciation in the first month of the first period of service for the main vehicle with a new first rate of 12,000,000 rubles and in the term of the koris vikoristan 10 roki (the heel of the depreciation group).

Analyze the insurance rates and depreciation amounts for all possible methods and identify the method that gives the maximum depreciation amount.

Methodical insertions

Linear method (per PBO 6/01)

The method transfers the regulation of equal rates and the amount of depreciation during any period of operation of the object. Rozrakhunok is carried out through displays on the river:

River depreciation rate: N = 1/SPI * 100%,

River sum A = (N/100%) * PKS

per month norm n=N/12

For a month sum a = A/12

SPI= 10 rokіv, also the norm for rіk N= (1/10)*100%=10% chi 0.1.

The actual amount of depreciation is more expensive A = 0.1 * 12,000,000 rub. = 1200000 rub.

per month norm n=0.1/12 = 0,008333 (0,8333%)

For a month the sum a = 1200000/12 = 100,000 rubles

Method of changing backfill (per PBO 6/01)

The method transfers the booking of the falling river depreciation amounts to the current river depreciation rates. The amount of depreciation is maximum in the first part, then the amount decreases due to skin damage, due to the rate of stasis in the deterioration of the excess wear of the main part. Rozrakhunok is carried out through displays on the river:

To maximize the amount of depreciation, select the maximum allowable coefficient – K=3.

River depreciation rate: N = K/SPI * 100%,

River sum A = (N/100%) * OS

per month norm n=N/12

For a month sum a = A/12

SPI = 10 rokiv, also the norm for rik N = (3/10)*100% = 30% chi 0.3.

The actual amount of depreciation is more expensive A = 0.3 * 12,000,000 rub. = 3,600,000 rub.

(For the first rock, the OS is still very good!)

per month norm n=0.3/12 = 0,025 (2,5%)

For a month the sum a = 3600000/12 = 300,000 rubles

Method of summing numbers of rocks in a string of korisnogo vykoristannya (for PBO 6/01)

The method transfers the calculation of the decline in river depreciation amounts for the decline in the river rates. The amount of depreciation is maximum in the first generation, and then the amount decreases with the risk of death, due to the reduction in the rate of depreciation of the main method from term to death. Rozrakhunok is carried out through displays on the river:

Cumulative number for 10 rocks: 1+2+3+4+5+6+7+8+9+10=55

River depreciation rate for the first life cycle N = 10/55 = 0.1818 = 18.18%

River sum A = N * PKS

per month norm n=N/12

For a month sum a = A/12

The actual amount of depreciation is more expensive A = 10/55 * 12,000,000 rub. = 2181818 rub.

per month n=(10/55)/12 = 0,01515 (1,515%)

For a month sum a = 2181818/12 = 181,818 rubles

The method of writing off the product in proportion to the obligation of the product (robot) is impossible to stagnate, the fragments of the term korisnogo vikoristan of tasks over the obligation of the product, and rocks.

5. Linear method (for subducting)

The method transfers the regulation of equal rates and the amount of depreciation during any period of operation of the object. Rozrahunok is carried out through displays for a month:

per month norm K=1/n * 100%

De n SPІ (term of korisnogo vykoristannya) expressions in months!

Monthly sum A = (K/100%) * PKS

SPI = 10 rocks, which means the norm per month K = (1 / (10 * 12)) * 100% = 0.833% or 0,00833.

The amount of depreciation per month is equal to A = 0.00833 * 12000000 rub. = 100,000 rub.

6. Nonlinear method (for subducting)

The method transfers the booking of declining depreciation amounts to the same depreciation rates for the month. The amount of depreciation is maximum in the first month, and then the amount decreases with each month, with the help of the stagnation of the expansion of the excess value of the main capital. Rozrahunok is carried out through displays for a month:

The depreciation rate is established by regulation (Article 259.2, paragraph 5 of the Tax Code of the Russian Federation). For the fifth depreciation group (division) you will set 2,7% (0,027) per month.

For a month sum A = (K/100%) * OS

The amount of depreciation per month is equal to A = 0.027 * 12,000,000 rubles. = RUB 324,000

Let's organize the results into a table:

Zavdannya

VAT "Spectrum" is engaged in the production of insulation materials from basalt fiber: stitching materials, panels. The company plans to implement an investment project in 2014 by launching the production of new products using the same material (insulation sections for pipes).

Design plan for the production of 456 thousand tons of insulation on the river (the plan is in progress)

Danish project for special equipment:

verstati - povna vartіst (including delivery and installation) 640 thousand. rubles, terminology korisnogo vykoristannya 12 rokіv.

Norm per hour per day: 0.17 year/t

Work mode: 2 shifts of 8 years, 258 working days per week

Planned downtime rate from ownership 4%

The project of unattracted ownership is being transferred at approximately 80%

Methodical insertions

In this period of production, the intensity of installation that is bought is set by the indicator “standard hour” - this is the hour in years that will be spent on cutting 1 ton of milk in one verstat.

Therefore, the following method is used to increase the intensity of the tension according to the norm of the hour (Nv):

Fpol - the basic fund of working hours per mile per river, is insured from the number of working days of the enterprise, and from the calendar days of weekends and holidays, from the number of working days. scheduled number of changes per day, based on planned equipment downtime:

Fpol = 258 days * 2 changes * 8 years * (100% -4%) = 4182 years * 0.96 = 3962.88 years

Thus, we realized that the leather production plant that is being designed can process and produce 23,311.0588 tons of finished products at an optimal rate.

However, beyond the fascination with the production of equipment over time, the situation is complicated and practically useless (equipment breakdowns, poor organization of work, human factor, for example, absence from work) is considered normal, as in the middle The demand is expected to be equal to 80%, which The project was laid down in the minds of the plant. We are planning to produce products in one versat with a maximum capacity of 80%.

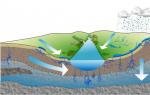

![]()

VPF - actual products released, units, tons or so;

Msg - average virobnica tension, pcs, tons or so.

Thus, the actual output of products per versat per river for an intensive factor of 80%:

VPf = Kint * Msr = 0.8 * 23311.0588 tons = 18648.84704 tons

The design plan for production is 456,000 tons, so to complete the production plan we will need N verstats:

N = 456,000 tons/18648.84704 tons = 24.4519 verstats.

We can only add the entire number of verstats, so it is necessary to round off the original number. In this case, it is necessary to praise the economically based management decisions, which require additional information about the project.

For example, if we are limited to financial resources, then we buy the necessary minimum, so that 24 miles, and so for the implementation of the production plan it will be necessary to ensure the attraction of a little more than the planned 80%.

If financial resources are available to us and the project transfers further developments beyond the obligations of activity, 25 versts can be added.

Let's assume that 25 versts are added, then the investment becomes:

640 rubles * 25 verstats = 16,000,000 rubles.

ZAVDANNYA ON NORMUVANNYA

Methodical insertions

The standard of working capital for virgin stocks shows the availability of the optimal stock for this type of cheese.

The normalization (calculation to the standard) of the production reserves is based on the multiplication of the planned average production cost for this element (Рср/day in rubles, which is determined by the production obligations) by the stock norm (N in days), insured according to the planned procurement regime For this element and other types of planned inventories:

The stock norm is calculated based on the total days of stock for each of the planned types of stock:

· Current stock purposes for ensuring the production of material resources between two food supplies, which is indicated ½ fasting period(it is recommended that when the supply period is less than 10 days, the flow stock rate is equal to the previous supply period).

· Transport stock Those deliveries are formed that result in a discrepancy between the terms of delivery of payment documents and materials. VIN is indicated as the relocation of the terms of delivery (the hour of delivery of the goods from the buyer to the buyer) over the terms of document management and is installed as the number of days of experience of vantage in the dosage(it is recommended that when the transportation period is more than 10 days, the transport stock is calculated as ½ of the transportation period).

· Safety stock is created to ensure the production of material resources for the period of possible damage to the supply chain and is installed as ½ type of in-line(or otherwise for established companies as hundreds of in-line stock).

· Preparatory/technological stock is created to ensure the production of material resources during the period of preparation of materials before production, including analysis and laboratory testing, such as actual number of days for preparation.

Thus, the established stock norm is determined by the following types of stocks:

· Current stock of 15 days = 7.5 days

· Transport stock Weekday

· Safety stock 0.7 * 7.5 = 5.25 days

· Preparatory stock 2 days

At once the stock norm is 7.5 +5.25 +2 = 14.75 days

The average value of vitrat is 150 m 3 *300 rubles/m 3 =45,000 rubles

The standard is 45,000 rubles * 14.75 days = 663,750 rubles

This means that for the normal functioning of the company it is necessary to invest 663,750 rubles in red clay.

Version: 663,750 rubles.

Werewolf Challenge

| -?- |

Werewolf

Accelerated turnover

Increased turnover

Imprint: Option 1

Imprint: Option 2

The vikoryst company has a turnover of 11,000,000 rubles and produces products worth 34,000,000 rubles. Estimate how the amount of costs in turnover will change, if the company is destined to produce 10% more products (by 37,400,000 rubles), estimate the amount of lost costs.

Methodical insertions

OPTION 1

OPTION 2

Cob = Compatibility of commercial products/Quantity of circulating capital

Cob/base = 34000000/11000000=3.09 sharp

Working capital Npl = Sobivartist plan/Kob/pl

Werewolf coins Npl = 37,400,000 / 3.54 = 10,562,260 rubles

Thus, the planned requirement for working capital is 10,562,260 rubles (as a general rule).

We increase the amount of working capital.

If there had been no change in the turnover, then it would have been saved at the same level as 3.09 revolutions per river, as in the base period. So for the production of 37,400,000 rubles, working capital was required from the amount:

Working capital Npl/f = Sobivartist plan/Kob/f

Werewolf funds Npl = 37,400,000 / 3.09 = 12,100,000 rubles.

This result is equal to the planned working capital:

The amount of working capital in the warehouse is 12,100,000 rubles - 10,562,260 rubles = 1,537,740 rubles (not the same).

TASKS FOR THE NUMBER OF PERSONNEL PLANNING

Plan the turnout for the day, the turnout for the change and the regional number of the main industrial workers, who are planning to earn 20,000 units. production at a rate of 5.5 standard hours per unit. It is planned to reduce the surplus of finished products in the warehouse by 100 units.

Work mode: 247 working days per day, 2 shifts of 8 years each. The work regime for healthcare workers will be stagnated by a 40-year working day. The allowance is set to 25 working days (35 calendar days/5 calendar days). The planned downtime rate is 5%, the cancellation rate is 1.1, the no-show rate is 12%.

Methodical insertions

When developing economical indicators, it is first necessary to choose a method that gives the most accurate result. Once in a planned number, it is possible to speed up the decomposition using a more precise method - according to the complexity of the production program, since we receive all the data before it stagnates.

The labor intensity of the production program is covered by insurance (Tpp(h) – the hour required for the production of the planned product)

Tpp = 20,000od * 5.5 standard hours = 110,000 hours

The planned hour of work of one worker for the production of products per rik is insurable - the effective fund of the working hour of one worker. It is designated as a time fund (the most accurate breakdown is given by the breakdown of the calendar according to each month, you can consult the data of the official calendar, which contains this amazing breakdown. Here http://www.buh.ru/info-63 or http://base). consultant.ru/cons/cgi/online.cgi?req=doc;base=LAW;n=137273) for the timing of the release of planned downtime associated with the organization of work and regulated downtime.

For these tasks, vikorystyu and the work calendar for a 40-year working year in the 1970s - the time fund of working hours, then:

Fef = (1970 - 25 vacation days * 8 years) * (1-0.05) = 1681.5 years

To expand the quantity, it is necessary to ensure the replacement of surplus finished products in the warehouse. In our case, the turnover in the warehouse varies with the labor intensity of the production program, which is likely to be a minus sign during expansion (a possible reversal situation, if the turnover in the warehouse increases the complexity of the production program, which results in This is due to the fact that we plan to increase the stock of finished products in the warehouse):

Osk = Nvr * ∆Qsk,

Osk = 5.5 standard year * (-100) = - 550 year

The required number of reports per day (without accounting for changes during the day):

Chav = ![]() = 59.17 chol or 60 osib per day

= 59.17 chol or 60 osib per day

NPV = ![]() = 68 osib

= 68 osib

When changing, the process of operational planning and decisions regarding the division of work during changes are determined. Once the decision has been made about the 50/50 division, then we distribute 60 robot workers at 30 individuals per shift.

Also, you need to hire 68 people, so that during the day 60 people per shift may be processed, or the number of turnouts per day is 60 people, and with a 50/50 split between shifts, the number of turnouts per change set to 30 osib.

TAKE CARE OF FINANCES

| -?- |

Preparatory planning of werewolf capitals

and management of turnover

Werewolf– the power of negotiators, which is assessed by two figures connected with each other:

1. number of revolutions per period (r_k)

2. the cost of one turnover of working capital in days.

Accelerated turnover There is always an increase in the number of revolutions and an overnight decrease in the number of revolutions.

Increased turnover is always reflected in a decrease in the number of revolutions and an overnight increase in the number of revolutions.

An effective economic situation is an accelerated turnover.

Accelerated turnover allows:

· Or increase output obligations (and therefore profits), with the same amount of working capital (without additional investments);

· or release the very same product that has been withdrawn from circulation (excess of circulating assets);

But the process is carried out overnight, so that the output increases, but for the sake of less investment in investment, less at the base turnover (also assessed by the increased value of the turnover).

Let's look at two options for practical planning of turnover costs based on an immediate increase in activity and change in turnover. The first option allows you to control turnover through the injection of turnover. The other has a lot of revolutions through keruvannya.

Imprint: Option 1

The vikoryst company has a turnover of 11,000,000 rubles and produces products worth 34,000,000 rubles. Estimate how the amount of money in turnover will change if the company is forced to produce 10% more products (by 37,400,000 rubles), reducing turnover by 15 days. Estimate the amount of valuable cash.

Imprint: Option 2

The vikoryst company has a turnover of 11,000,000 rubles and produces products worth 34,000,000 rubles. Estimate how the amount of money in turnover will change if the company is forced to produce 10% more products (by 37,400,000 rubles), increasing turnover by 0.45 times. Estimate the amount of valuable cash.

Methodical insertions

OPTION 1

Insurance turnover in the base period:

Cob = Compatibility of commercial products/Quantity of circulating capital

Cob/base = 34000000/11000000=3.09 sharp

Trival of turnover in the base period:

Dbase = 365/3.09 = 118.09 days per revolution

During the planning period, there is 1 option in mind:

Dpl = Dbase - change planned

Dpl = 118.09 - 15 = 103.09 days in trivatime one turn of the offensive fate behind the plan

Cob/pl = 365/Dpl =3.54 times per river

Working capital Npl = Sobivartist plan/Kob/pl

Werewolf coins Npl = 37,400,000 / 3.54 = 10,562,260 rubles

Thus, the planned requirement for working capital is 10,562,260 rubles (as a general rule).

We increase the amount of working capital.

If there had been no change in the turnover, then it would have been saved at the same level as 3.09 revolutions per river, as in the base period. So for the production of 37,400,000 rubles, working capital was required from the amount:

Working capital Npl/f = Sobivartist plan/Kob/f

Werewolf funds Npl = 37,400,000 / 3.09 = 12,100,000 rubles.

This result is equal to the planned working capital:

The amount of working capital in the warehouse is 12,100,000 rubles - 10,562,260 rubles = 1,537,740 rubles (not the same).

OPTION 2

All the results will be the same, but if the algorithm for the development changes, it will be forgiven, so we have no need to use the indicator D, and we can carry out all the developments at a turnover rate in times

Also, insurance turnover in the base period:

Cob = Compatibility of commercial products/Quantity of circulating capital

Cob/base = 34000000/11000000=3.09 sharp

During the planning period, there are 2 options:

Cob/pl = Cob/base + change planned

Cob/pl = 3.09 + 0.45 = 3.54 times per river

Working capital Npl = Sobivartist plan/Kob/pl

Werewolf coins Npl = 37,400,000 / 3.54 = 10,562,260 rubles

Thus, the planned requirement for working capital is 10,562,260 rubles (as a general rule).

We increase the amount of working capital.

If there had been no change in the turnover, then it would have been saved at the same level as 3.09 revolutions per river, as in the base period. So for the production of 37,400,000 rubles, working capital was required from the amount:

Working capital Npl/f = Sobivartist plan/Kob/f

Werewolf funds Npl = 37,400,000 / 3.09 = 12,100,000 rubles.

This result is equal to the planned working capital:

The amount of working capital in the warehouse is 12,100,000 rubles - 10,562,260 rubles = 1,537,740 rubles (not the same).

MANAGEMENT OF SHARES

Zavdannya 1

The joint stock company "AAA" issued 500,000 shares.

The nominal value of one share is 10 rubles.

400,000 shares are primary, 100,000 shares are preferred with a 5% dividend.

Insure dividends and yields on shares of all types, which are planned until the division of the shareholders' profits BAT becomes 1,000,000 rubles.

Methodical insertions

Dividend - This is part of the profit of the joint-stock partnership, which is paid to them on the shares under consideration of the decisions of illegal fees; This is the income of the holder of the shares, which overrides the procedure established by this partnership.

Dividends in a joint stock company are established and paid directly on preferred and primary shares.

The owner of the preferred share has an advantage in the deduction of dividends from the equal share of the owner. Owners of different types of preferred shares may be subject to a different degree of unkindness from their spouse, which may be determined by the statute of matrimony.

In the future, decisions will be made on the payment of dividends on the outstanding shares.

Nominal value of the share Rn

N– limited number of shares, of which no more than 25% are preferred - Npr, Other conditions - Nob

Statutory capital AT = Рн × N = (Рн × Npr) + (Рн × Nob)

Balance sheet value of the share RB is indicated on the due date for the balance sheet

Rink's share of shares RR The price for which a share is bought and sold at the moment on the market is determined by exchange quotations, after the fact of sale.

Dividend rate on shares – i

Dividend amount I

The amount of dividends I and the dividend rate are related to the formula I = i × Pн

For preferred shares, dividend payments are established at the time of issue (often through fixation or fixation of income)

For major shares and dividend payments, the shareholders' fees are determined promptly.

Decision

Dividends from preferred shares are insurable:

Ipr = i × Pn = 5% * 10 rub. = 0.05 * 10 rub. = 0.5 rubles per share

For all preferred shares: Amount Ipr = I pr * Npr = 0.5 rub / pc * 100,000 pcs = 50,000 rubles

Dividends are paid from preferred shares

1,000,000 rubles - 50,000 rubles = 950,000 rubles

The Institute of Preferred Shares has not yet gained popularity in modern Russia, although it appeared almost overnight with the first joint stock companies. Prote, the data of the CPU are deprived of the respect of legislators, as well as the dividend policy of the AT.

What is it like?

In addition to initial shares, the form of capital does not give the shareholder the right to vote among the shareholders. The corporation undertakes to pay them the fixed dividend declared at the time of the first issue.

In times when a company is unable to pay all dividends, holders of preferred valuable papers may have priority over applications for major shares.

Thus, the essence of the preferred shares lies in the present: the exchange of funds for the enterprise in general and its effectiveness, for the time being, may be compensated by stable income and other technical advantages in front of the holders of the common shares on which it is invested main responsibility for the activities of the company.

Main authorities

The owners of prefs, as a rule, give up the right to a first-order regime before dividends, in exchange for the ability to insure on profits on the amount of dividends received.

Any superior shareholders can revoke the right to share. However, the majority of such shares do not share the same fate with the issue.

To take a more detailed look at the specifics of the dividend policy, it is necessary to look at the main features between simple and preferred shares.

Features of two types of shares:

| Sign | I'm sorry | Privileged |

| Amount of dividends | For decisions on secret gatherings of shareholders | It is clearly stated in the statute |

| Term "pay" | Until the beginning of the day of praise for the sacred collections, the decision on payment will be made | Until one day after the end of the world |

| Dzherela dividends | Net profit of stark fate, non-divisional profit | Net income from capital, non-distribution income, reserve capital, special fund |

| Principles obmezhennya viplat chi vikupu | Exact dividends on preferred shares have not been paid in full | Exact dividends on preferred shares, the owners of which are subject to the disadvantage of removing dividends, have not been paid in full |

| Systematicity of payments | They follow the decisions of shareholders, but not more often than once a day | Shhorichno |

| Right to vote | Neporushne | Only in the fallouts, subject to legislation |

The popular distinction between simple and preferred shares is based on the preferences of government officials for the remaining dividends and the possibility of seizing part of the enterprise for its liquidation.

And also a complete compensation for these benefits to the savings or related exchanges of rights to manage the joint stock company.

Benefits from dividends are manifested in:

- fixation of their size and expansion mechanism for the release of instruments;

- clear payment frequency;

- expansion of Dzherel Viplat;

- strengthening the exchange of dividend payments for common shares for the discovery of illegal claims to the owners of the preferred shares.

At the legislative level there is a change in the situation when such shares vote:

- Once a decision is made to reorganize or liquidate the corporation.

- To praise the decision to disseminate singing information.

- Once changes are made or an addition is made to the partnership statute, such as to demarcate the rights of the owners of the preferred shares.

All the above-mentioned attacks allow the rulers to defend their rights, to protect interests, and not to overrule the joint-stock company.

Video: Zvichaini

Dividend on preferred shares and fixed income

Users of this type of CPU can be reimbursed for a fixed amount of income. The amount is set at the time of issue.

Ukrainian legislation establishes 3 options for determining the amount of such payments:

- The sum is solid.

- About 100% of the nominal value.

- Establishment of the order of payment of sums and payments to the vlasniks of the CPU.

The dividend can be paid in shares, bonds, and goods. This process is called profit capitalization.

The Corporation will announce the amount of payments in accordance with the settlement of the paid tax.

Tipi

The number of possible types of preferred CPUs is determined by the rights and nominal rating, and is therefore not practically limited.

The main types are:

- Cumulative. Vlasniks of such CPUs can recover the accumulated debt from payments through financial impossibility. Borg accumulates in dividend arrearage and is paid out at the beginning of the world and after three fates.

- Non-cumulative.

- With a fixed profit. The amounts are determined at the time of release of valuable papers and change over the course of the current period.

- Shares for participation - transfer the exchange of the lower limit to the dividend.

- Redeemable – the company reserves the right to reclaim the CPU.

- Convertibles, which facilitate exchange for simple promotions.

Conversion and redemption

Preferred shares of the first class may be converted into similar shares of a different class or simple shares.

One of the most important minds in this conversion (exchange) is to change the size of the statutory capital of the corporation. In addition, some of them cannot exceed 25% of statutory capital. However, the legislator failed to establish a consistent relationship between the nominal value of prefs and primary shares.

For conversion, simple registered shares may use the following instructions:

- The decision regarding the placement of additional common shares, in which prefs are converted, is praised,

- singing behind the number of voices of shareholders;

- one placed preferred share is converted into one simple registered share;

- the nominal value of converted valuable papers may be up to date;

- Additional deposits and other payments are not allowed;

- the conversion procedure must be completed in one day on the basis of records on the accounts;

- placement of ordinary shares takes place among all shareholders-owners of preferred valuable securities;

- CPU conversions and results are cancelled.

Conversion of preferred shares to similar securities of a different class is possible:

- in the process of consolidation of all placements of shares, as a result, two or more shares are converted into one new one;

- in the process of crushing the nominal value;

- As a result of anger, it was accepted as a part of marriage.

When it comes to purchasing shares, we are talking about valuable papers. Companies may have the right to issue this type of shares, depriving themselves of the right to call them.

In this case, the company may inform you about the specific date on which the shares will begin to be redeemed. Shareholders must be notified 30 days before the start of the purchase.

The estate does not have the right to effect a redemption until the repayment of current dividends on the preferred shares, the owners of which may benefit from their withdrawal.

Price

The market value of the analyzed category of valuable papers is lower than the main stocks by 25-40%. At the same time, the obov'yazkova's mind of the current state - the total nominal capital is not required to exceed 25% of the statutory capital of the AT.

As for the theoretical aspect of the value of the value of one valuable paper of this kind, then for those who are already in the market, it is determined by setting a cash dividend on 1 share before its market price:

de D p - Dividend amount;

P p – current stock of the share.

The rate is determined by the rate of return.

If the corporation plans to create a new project, then it will be necessary to cover additional expenses for its development.

The matime formula looks like this:

Up to p = D p / (P p -F) * 100%

de F – Vitrati emіsіyu.

Russia has so many joint stock companies that are willing to receive additional investments by issuing valuable valuable papers.

It still stinks, though:

- Rostelecom;

- Oschadbank;

- Surgutnaftogaz;

- AvtoVAZ;

- Bashneft;

- Mechel;

- Tatnafta;

- Transnafta (including the preferred CPU).

To become the owner of the shares of reinsurance enterprises, you will need:

- Open the brokerage account and deposit the necessary amount for the new one.

- Install a trading terminal.

- Add valuable paper to scribble.

Some investors give priority to preferred shares for the same reason that they, like bonds, provide more guarantees for income reduction. And the right to vote is never lost to future shareholders.

Thus, the appearance of preferred shares is connected with the attempts of joint stock companies to obtain additional capital to the statutory capital, at the same time giving such shareholders a minimal opportunity to take a special part in the managed partnership .

The issue of preferred shares makes it possible to receive cash and not allow third parties to control it.

First of all, the decision was made to deny a stable income to his bosses. For all partnerships with a similar line of business, the main method of distributing the collected profits is the payment of dividends, which is regulated by a number of laws, as well as internal documents of the LLC. Therefore, people in power may suffer from a lack of nutrition associated with this complex process.

Types of dividends

Dividends mean an absolutely legal option for withdrawing income from capital investment from an enterprise. On the accounting and financial side, dividends are the main part of the net profit withdrawn. It is practically always distributed between the authorities and participants, depending on the contribution to the statutory fund.

In economic practice there is a rich classification of this concept.

Stinks are divided into the following types:

For the type of promotions you can follow:

- on simple shares;

- On the privileged papers.

For payment frequency:

- Monthly periods (they are very rare);

- Quarterly;

- Pivrichni;

- For the pouches of fate.

For the Viplat form:

- penny equivalent;

- Maintain chi has a natural form.

For the amount of payment:

- private;

- Povni.

For awareness:

- Mainly behind the bags are the robots of the enterprise;

- Addendums (special ones according to the drawings).

All these options for paying dividends to the LLC may be enshrined in statutory documents, regulating the subtle procedures for distribution and payment.

Dzherelo for collecting dividends

The expansion and payment of dividends will only be lost from the amount of net profit that will be lost from the newly ordered enterprises after the payment of taxes and taxes has been reduced. However, the legislation on TOV practically does not interfere with the understanding of net profit. Therefore, the basis is taken from the accounting data of the enterprise, which is documented by additional documents.

These documents have a row that shows non-distribution of profits or indicates non-critiqued surplus in the activity of the singing period. The concept of “non-distribution of profits” reflects the economical result of all types of activities minus tax deductions and taxes, including penalties (clause 79 of the Accounting Regulations, etc. sti do).

There is a need to set aside the amount to pay dividends both at the time of collection and immediately before the distribution of the amount. This is due to the possible change of net income through accounting adjustments or the introduction of additional changes to the balance sheet.

The amount recorded on the balance sheet is the basis for the breakdown of dividends. The decision is made by the decision makers will accept the share of payment. Since the statutory fund of such a partnership has a communal and sovereign share of the funds, it is required to pay at least 30% of the net river profit.

How to praise the decision to pay dividends to TOV

Arrangement and payment of dividends to all founders and participants of the LLC is a right, and not an obligation that is enshrined in a statutory document. According to the legal rule of the distribution of dividends of a LLC, it is necessary to invest proportionally in its statutory fund to the parts (Clause 2 of Article 28 of the Law on LLC).

All nutritional requirements for the division of the partnership’s net profit are contained in the documents:

- Provisions of the statute;

- Corporate agreement between participants;

- Provisions for distribution of profits (internal).

The law does not prohibit making changes to documents and paying dividends to disproportionately invested capital of participants. In practice, the situation becomes more complicated when such a corporate agreement is reviewed and new terms are introduced, which may give rise to the right to withdraw part of the cash income. The main idea is to conduct secret meetings to make necessary additions to the agreement for the unanimous praise of all participants of the LLC. And here you can exchange a change to the corporate agreement without revising the statute (Civil Code of the Russian Federation, Art. 66.1 and Art. 67.2).

It is established by law that all potential participants must be notified about the training 30 days in advance. Payment will be made to all persons registered with the register, regardless of their presence at the meeting.

All meals that depend on the amount of dividends paid are determined only at official meetings with the participation of the founders of the partnership (Law on TOV, paragraph 7, paragraph 2, article 33). This important function cannot be fulfilled by any other organization (as it puts pressure on the management of the company in relation to the division of income).

To discuss and discuss the possibility of paying dividends:

- External meetings are collected for which financial documentation and accounting records are submitted;

- A portion of the withdrawn income is allocated for the payment of dividends to the participants of the LLC, and decisions are also made about the procedure for dividing the amount;

- A collective decision is made about the terms and form of payments on the basis of a mathematical majority from the number of present participants in the partnership.

After carrying out the collection on the basis of the signed protocol, the service of the TOV may be issued as a final order.

If you cannot make a decision

Physicians, who pay dividends for personal accounts without the right of a limited liability company, may not decide to direct all income to the development and modernization of production facilities and other general needs.

If there are situations in which decisions will not be taken or may be found illegal:

- Until the time of purchase of all issued shares at the benefit of the founders and shareholders;

- Since the partnership's financial assets are not limited to the necessary amount of net assets;

- Until the full payment of contributions to the statutory fund of TOV;

- With the best signs.

If you praise the decision in circumventing such situations, you may be disgraced by the court procedure if you are a participant of the LLC.

Term for payment of dividends from TOV

In a partnership with an interconnected periodicity, the lines of payment of increased dividends may be regulated by statute and internal regulations. Most often, a decision on the payment of dividends to a company is made after the receipt of funds for the entire world, or perhaps quarterly or even monthly (Law on TOV, paragraph 3, article 28). Dividends that are paid once per quarter every quarter are called intermediate.

Most often, the payment term is made before the statute at the stage of business creation. In any case, the maximum permissible period after making a decision is not required to exceed 60 days. In individual cases, the parents convey the possibility of extending payments up to 3 times. In such a situation, any participant of the LLC has the legal right to transfer to the court authorities and withdraw his portion from the amount of undivided profits (resolution of the Federal Antimonopoly Service of the Pivnichno-Zakhidny District dated January 21, 2013 N F07-78 46/12).

Dividend payment form

In most cases, dividends are paid to shareholders in penny form. In addition, the statute may have a payment transferred to another lane. Almost always there are powerful shares and valuable papers of subsidiaries. This economical practice is called “reinvestment” or “income capitalization”. There is an increasingly stagnant economy and the development of enterprises, their expansion and modernization.

How to withdraw dividends

The right to withdraw income and pay dividends to the LLC is available to all participants who were registered in the special register at the time of the payment decision. The same applies to the authorities, but the rest may have some nuances in the statutory documents.

The situation is complicated when payments are divided between holders of various shares. The remaining ones must be entered into a special register, compiled by a list of the maximum number.

The remaining changes to the law have an important nuance: when selling shares after the day of the register for payment of dividends, the current owner retains the right to withdraw this type of income for the previous period.

There is a lot of evil in the form of shares: for the most important and preferred shares, hundreds of net profits are paid separately.

After the planned gatherings and the completion of all organized meals, the church can collect dividends according to the accepted protocol and order. If the calculation of dividends of the TOV was transferred to shares and proportions of the amount contributed, then the formula can be set up:

Net profit× Participant's share (in %)

This is a simple formula that explains how to recover dividends from a limited liability company in most situations. It is also valid for the need to distribute dividends to TOV at . In other cases, the amount that falls on the action or part will be regulated by the protocol of underground gatherings.

To expand the amount that falls on a share, it is necessary to use the dividend yield ratio:

DD = (Amount of dividends per rik / Rinkova vartist)× 100%

All items may be deleted at the time the registry is closed. After which, the PDF for dividends is obligatory from the amount. Nina wins 13%.

How to pay dividends to the founder of LLC

In accordance with the laws and statutes of the partnership, the calculation of the amount of dividends to the founders can be obtained without the adjustment of hundreds of shares from the statutory fund. However, such a possibility may be guaranteed by statutory documents and duly executed. Otherwise, unpleasant controversial situations often arise before the filing of a tax inspection.

This feature is connected with the interpretation of Article 43 of the Tax Code of the Russian Federation, which defines dividends as the financial income of a participant in the partnership, which must be paid in an amount that is proportional to the share’s investment. Since the amount seized by the director of the hundreds is exceedingly registered and not documented by statutory documents, the collection of funds for them will be carried out at a larger scale. The tax service has the right to equate such dividends to another type of income.

The law states that marriage can be created by one person. Which type of praise, which involves the payment of dividends to the sole founder of the LLC, is accepted by him uniformly. At the moment, there is no clear explanation of the form of the collection protocol for this issue, but it is obvious that all control and inspection bodies are responsible.

Dividends from preferred shares

Preferred shares may be entitled to pay dividends to their owners. In most situations, there are hundreds of payments due to the division of the proceeds of the partnership statute, or they may lie under the nominal value of the share.

Main advantages over major promotions:

- There is a clear fixation of the dividend distribution mechanism;

- Pevna periodicity narahvan;

- Expansion of perelik dzherel for payment;

- The advantage is to take off hundreds of hundreds.

During the period of stable and profitable work, the companies of TOV create special funds in which they reserve part of their profits. When there is a shortage of financial resources, funds from such “reserves” are spent on paying dividends in addition to the issued preferred shares (Law on AT, Article 42, paragraph 2).

At the same time, since no special rate has been established for the preferred shares, their owners will deduct dividends from an amount that is equal to the preferred shares. If the board of directors of the partnership has decided not to make payments for funds during an unpleasant period, the holders of the privileged shares also do not have the right to withdraw their share.

Dividends for LLC participants are most often paid in penny form.

Money can be transferred between individuals in the following main ways:

- for an open container at any bank (unprepared method);

- Through the cash register for cooking.

If the date of the remaining payment day falls on a holiday or weekend, it may be moved to the next business day. The amount of dividends is transferred to the accounts without adjusting the lost taxes.

Liability for non-payment of dividends

Since the partnership violates the rights of shareholders and participants from the payment of dividends, the rest may be taken to court for their privileges. The next order may have hundreds of hundreds assigned for the entire stitching period. In such situations, the failure to pay payments results in administrative offenses (CAP Art. 15-20).

If a partnership with interconnected validity is actually a subject of government, then the court hearing will be held only in the arbitration court (when a person submits a call).

If a participant of the LLC does not reject dividends for objective reasons (without providing reliable information about the place of residence, divisional structure or other clarifications), he can withdraw them from the partnership for 3 years after the date of termination chennya viplat. If a pre-trial audit reveals that the reason for non-payment was the failure to resolve the division of dividends, the call will be granted.